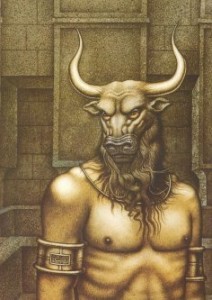

Minotaurus je obří člověk s býčí hlavou, je to potomek manželky krétského krále Mínoa Pásifaé a jeho otcem je posvátný bílý býk. Minotaurus byl uvězněn v knóssoském labyrintu, který postavil Daidalos. Athenský král zabil při hrách Mínóova syna, proto vypukla válka, kterou Athény prohrály, a tak athenský král byl nucen posílat 7 chlapců a 7 dívek každých 9 let (jiné prameny uvádějí 1 rok). Jediný, kdo si na Minotaura troufl, byl Théseus, který měl být jedním z obětovaných. Avšak Ariadna dcera krále Mínoa mu dala klubko , aby se podle odvíjené nitě mohl vrátit zpátky.Théseus Minotaura zabil.

, aby se podle odvíjené nitě mohl vrátit zpátky.Théseus Minotaura zabil.

Komentáře

Přehled komentářů

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(LamaAllep, 8. 2. 2024 16:31)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(LamaAllep, 8. 2. 2024 11:37)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(LamaAllep, 8. 2. 2024 11:23)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(LamaAllep, 8. 2. 2024 6:37)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(LamaAllep, 8. 2. 2024 6:20)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Guest Post permanent on DA 70

(JosephBut, 8. 2. 2024 5:48)

We bring you latest Gambling News, Casino Bonuses and offers from Top Operators, Online Casino Slots Tips, Sports Betting Tips, odds etc.

https://www.jackpotbetonline.com/

Boost Your Digital Security

(ilyakomarov, 8. 2. 2024 1:52)Eager to boost your online security with ease? Our freelance services have got you protected! From strengthening your online platform against bots to simplifying file sharing, we've got simple solutions for everyone. https://toproll.cf

SEARCHING FOR LOST BITCOIN WALLETS

(LamaAllep, 8. 2. 2024 1:25)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(LamaAllep, 8. 2. 2024 1:10)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(LamaAllep, 7. 2. 2024 19:34)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(LamaAllep, 7. 2. 2024 19:17)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Men Dating Men: Celebrating Angel and Pull

(AlbertWeplY, 7. 2. 2024 16:02)

Men dating men sample tenderness, consistency, and the beauty of relationships in their own unmatched way.

https://ca3h.com/tags/bareback/

In a world that embraces diverseness and inclusivity, same-sex relationships from develop their place. Men who fixture men navigate the joys and challenges of erection substantial connections based on authenticity and reciprocal understanding. They celebrate enjoyment from while overcoming societal expectations, stereotypes, and discrimination.

https://zeenite.com/tags/milf-mom/

Communication and emotional intimacy have a good time a essential task in their relationships, fostering trust and deepening their bond. As institute progresses toward conformity, it is noted to recognize and particular the care shared between men dating men, embracing their unequalled experiences and contributions to the tapestry of someone connections.

BTC PROFIT SEARCH AND MINING PHRASES

(LamaAllep, 5. 2. 2024 17:00)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(LamaAllep, 5. 2. 2024 16:39)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(LamaAllep, 5. 2. 2024 10:38)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(LamaAllep, 5. 2. 2024 10:21)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(LamaAllep, 5. 2. 2024 6:33)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(LamaAllep, 5. 2. 2024 2:06)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(LamaAllep, 4. 2. 2024 21:54)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59

BITCOIN CRACKING SOFTWARE

(LamaAllep, 8. 2. 2024 22:13)